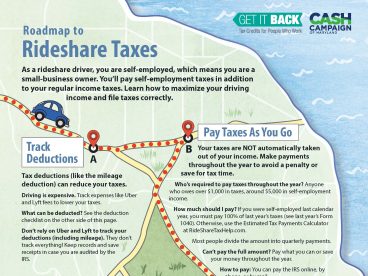

As a rideshare driver, you are self-employed, which means you are a small-business owner. You’ll pay self-employment taxes in addition to your regular income taxes. Learn how to maximize your driving income and file taxes correctly.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities and the CASH Campaign of Maryland are not liable for how you use this information. Please seek a tax professional for personal tax advice.

Lower your taxes by claiming tax deductions

You are eligible for tax deductions for business expenses that can reduce your taxes. Compile a list of these tax deductions with receipts and keep a mileage log so you’re prepared to file.

Pay taxes as you go (quarterly estimated payments)

Your taxes are NOT automatically taken out of your income. Make estimated payments throughout the year to avoid a penalty.

File Your Taxes

If you make over $400 in self-employment income, you must file. You’ll need to file Schedule C and Schedule SE with Form 1040. You’ll find your rideshare income information on your driver dashboard.

These resources are available to help with your taxes

Roadmap to Rideshare Taxes Cheat Sheet

Review and print out the Roadmap to Rideshare Taxes Cheat Sheet as a reference.

Tax Deduction Tracker and Mileage Log

Track your tax deductions and mileage in these two spreadsheets.

Before you file your taxes, fill out the Rideshare Tax Organizer to make sure you have everything you need.